EURUSD Trading

How To Start eurusd Trading In 15 Minutes

EURUSD Trading: The Ultimate Guide for Forex Traders 2024

Introduction

EURUSD trading is one of the most popular activities in the forex market, attracting both beginner and experienced traders. As the most traded currency pair globally, EURUSD represents the value of the euro (EUR) against the US dollar (USD). The pair’s significance comes from the fact that it brings together two of the world’s largest economies—the European Union and the United States. This makes EURUSD trading highly liquid and offers tight spreads, making it an appealing choice for traders looking for efficient execution and low transaction costs.

Its high trading volume ensures a steady flow of market data, making analysis easier and strategies more reliable. For those who prefer day trading, swing trading, or even scalping, EURUSD is a flexible and accessible option, thanks to its frequent price movements during key trading sessions.

What Is EURUSD?

EURUSD, also known as the Euro Dollar, represents the exchange rate between the euro (the official currency of the European Union) and the US dollar (the currency of the United States). In forex trading, it is written as EUR/USD, where EUR is the base currency and USD is the quote currency. This means that if the EUR/USD rate is 1.10, it costs 1.10 US dollars to buy one euro.

The forex market operates on the concept of currency pairs, where traders speculate on the rise or fall of one currency relative to another. In the case of EURUSD, traders make profits (or losses) based on how the exchange rate between the euro and the dollar fluctuates over time. Forex traders can either go long (buy) if they believe the euro will appreciate against the dollar or go short (sell) if they think the euro will depreciate.

Several factors influence the EURUSD exchange rate, and understanding these is crucial for successful trading:

- Economic Indicators: Key reports like GDP growth, unemployment rates, and inflation figures from both the European Union and the United States can move the EURUSD rate. For example, strong US economic data might strengthen the dollar, leading to a decrease in the EURUSD pair.

- Central Bank Policies: Monetary policy decisions from the European Central Bank (ECB) and the US Federal Reserve have a significant impact on EURUSD. Interest rate hikes, quantitative easing, or changes in inflation targets can all drive the exchange rate up or down.

- Geopolitical Events: Political instability, trade agreements, and international tensions also play a role in influencing EURUSD. For example, uncertainty around Brexit negotiations previously caused fluctuations in the euro.

These factors make EURUSD trading a dynamic and constantly evolving landscape, providing traders with numerous opportunities to capitalize on short-term and long-term market movements.

Why Trade EURUSD?

One of the primary reasons traders are drawn to EURUSD is its high liquidity. As the most traded currency pair in the forex market, EURUSD experiences consistent buy and sell orders, ensuring that trades can be executed quickly and with minimal slippage. The tight spreads that result from this liquidity also make EURUSD an attractive option, as lower transaction costs can translate into higher profits, particularly for high-frequency traders like scalpers.

The availability of comprehensive market data and analysis is another major benefit of trading EURUSD. With both the euro and the US dollar representing two of the world’s largest economies, there is a wealth of economic reports, expert analysis, and real-time market data readily accessible to traders. This abundance of information allows for more accurate predictions and the development of well-informed trading strategies.

EURUSD is also known for its heightened volatility during certain trading sessions, particularly when the European and US markets overlap. During these periods, liquidity is at its highest, and price movements become more pronounced, providing traders with more opportunities to capitalize on short-term price fluctuations. This makes EURUSD particularly appealing to day traders who rely on volatility to generate profits.

Different types of traders can take advantage from the unique advantages of EURUSD trading. For day traders, the pair’s frequent price movements during peak trading hours create ample opportunities for short-term trades. Swing traders, on the other hand, can take advantage of larger market trends driven by economic data and central bank decisions. Position traders may focus on long-term trends, using fundamental analysis to inform their strategies, while scalpers can rely on EURUSD’s liquidity and tight spreads to execute numerous trades in a short time.

Difference Between Long Trading and Short Trading

In forex trading, understanding the concepts of long trading and short trading is essential for making informed decisions. These terms refer to the direction of a trade, or whether a trader expects the price of a currency pair to rise or fall.

EURUSD Long Trading

When a trader goes “long” on EURUSD, they are buying the euro (EUR) with the expectation that its value will increase relative to the US dollar (USD). In other words, the trader believes that the EUR/USD exchange rate will rise. For example, if the EUR/USD rate is currently 1.10, and a trader goes long, they are hoping the rate will increase to something higher, such as 1.12. If this happens, the trader can sell the euro at a higher price and make a profit. Long trading is generally used in bullish market conditions, where traders are confident that the value of the base currency (EUR) will rise.

EURUSD Short Trading

Short trading, on the other hand, involves selling the base currency (EUR) with the expectation that its value will decrease relative to the quote currency (USD). When a trader goes “short” on EURUSD, they believe the exchange rate will fall, allowing them to buy back the euro at a lower price. For example, if the EUR/USD rate is 1.10 and a trader expects it to drop to 1.08, they would go short. If the rate does fall, the trader can then repurchase the euro at a lower rate, pocketing the difference as profit. Short trading is typically used in bearish market conditions when the trader anticipates the value of the euro will decline.

Key Factors That Affect EURUSD

Several key factors influence the movement of the EURUSD exchange rate, and understanding these can help traders make more informed decisions.

The policies of the European Central Bank (ECB) are among the most significant drivers of EURUSD. The ECB sets interest rates and implements monetary policies that affect the strength of the euro. For example, when the ECB raises interest rates, the euro tends to appreciate as higher rates attract more investment. Conversely, monetary easing, such as lowering interest rates or introducing stimulus measures, can weaken the euro. Traders need to closely monitor ECB meetings and announcements to stay ahead of potential market shifts.

The decisions made by the US Federal Reserve (Fed) are equally important. Similar to the ECB, the Fed’s monetary policy has a direct impact on the value of the US dollar. Interest rate hikes by the Fed typically lead to a stronger dollar, which in turn can cause the EURUSD pair to decline. On the other hand, dovish Fed policies, such as maintaining low interest rates or engaging in quantitative easing, can weaken the dollar, causing the EURUSD pair to rise. Federal Reserve announcements, especially those related to interest rates, are key events for EURUSD traders to follow.

Economic data from both the Eurozone and the United States also plays a crucial role in determining the direction of the EURUSD exchange rate. Reports such as GDP growth, employment figures, and inflation rates provide insight into the health of these two economies. For example, stronger-than-expected US job numbers might boost the dollar, leading to a decline in EURUSD. On the flip side, positive economic reports from the Eurozone could strengthen the euro, driving the EURUSD pair higher.

Political events and global economic factors also influence EURUSD movements. Events like Brexit, US elections, or trade wars can cause significant volatility in the currency markets. Political instability or unexpected policy changes can weaken investor confidence in a currency, leading to sharp fluctuations in the exchange rate. Global economic factors, such as trade agreements or shifts in commodity prices, can also have a ripple effect on EURUSD. Traders need to stay informed about major geopolitical developments to anticipate potential market reactions.

Best Times to Trade EURUSD

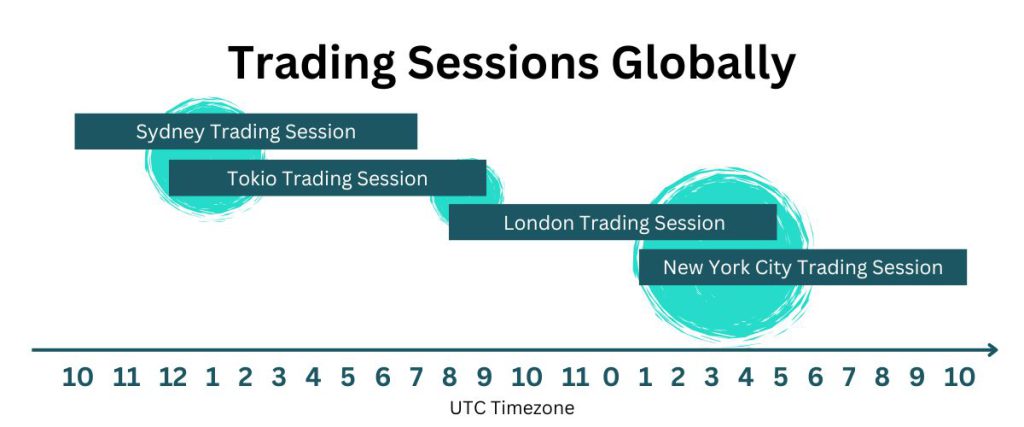

The EURUSD pair is most active during the overlap of the London and New York trading sessions, which typically occurs between 8:00 AM and 12:00 PM EST. This period sees the highest trading volume as both the European and US markets are open, leading to increased liquidity and more significant price movements. The high liquidity during this overlap is particularly beneficial for day traders and scalpers, who rely on quick price fluctuations and tight spreads to execute profitable trades.

Timing is crucial when trading EURUSD, as different trading strategies depend on market volatility. Day traders, for instance, often look for volatile periods where the price moves significantly within a short timeframe, allowing them to capitalize on rapid shifts in the market. Swing traders, on the other hand, may prefer to hold positions for longer periods and may not be as reliant on volatility, focusing instead on broader trends influenced by economic data releases.

While the London and New York sessions provide the best trading opportunities, the Asian session (typically from 7:00 PM to 4:00 AM EST) tends to have lower liquidity and smaller price movements in the EURUSD pair. During this time, market activity slows down, and spreads can widen, making it more difficult to execute trades at favorable prices. Traders looking to avoid these low liquidity periods should focus on the London-New York overlap and other times when economic news from the Eurozone or the US is expected, as these events often trigger volatility.

Tools and Platforms for EURUSD Trading

To succeed in EURUSD trading, traders need access to reliable tools and platforms that allow them to analyze the market, execute trades, and manage their positions efficiently. Popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader are widely used by traders due to their robust features, user-friendly interfaces, and access to real-time market data. These platforms offer everything from basic order execution to advanced tools for automated trading, making them suitable for both beginners and experienced traders.

Charting tools are essential for EURUSD traders to analyze price movements and identify trends. Platforms like TradingView and the built-in charting tools in MT4, MT5, and cTrader allow traders to view real-time charts, apply technical indicators, and draw trendlines to inform their trading decisions. Access to customizable charting options is particularly useful for traders who use technical analysis to identify entry and exit points in the market.

For beginners, demo accounts are a valuable resource for learning the ins and outs of EURUSD trading without risking real money. Most trading platforms, including MetaTrader and cTrader, offer demo accounts that simulate live market conditions, allowing new traders to practice executing trades, using indicators, and managing positions in a risk-free environment. This hands-on experience is crucial for building confidence and developing a solid trading strategy before transitioning to a live account.

Risk Management for EURUSD Trading

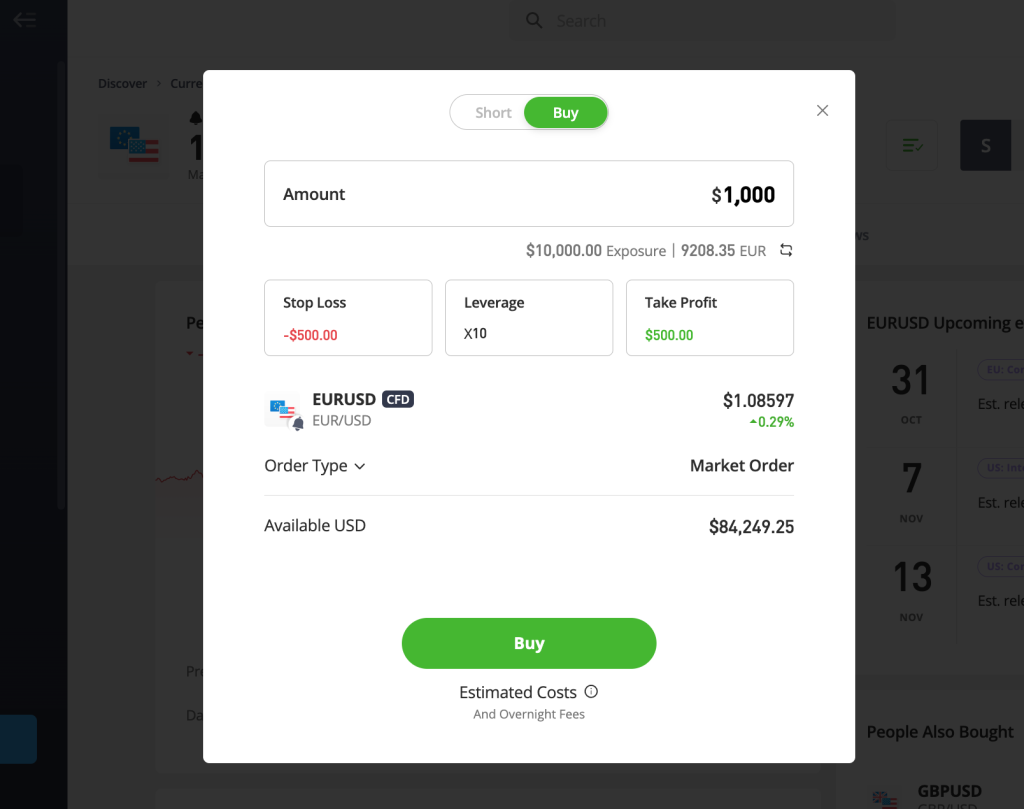

Effective risk management is essential for successful EURUSD trading, as it helps traders protect their capital and avoid significant losses. One of the most important risk management tools is the use of stop-loss and take-profit orders. A stop-loss order automatically closes a position when the market moves against the trader by a certain amount, limiting potential losses. Similarly, a take-profit order ensures that a trade is closed when the market reaches a pre-set level of profit. By using these tools, traders can minimize emotional decision-making and maintain discipline in their trading.

In addition to stop-loss and take-profit orders, understanding and applying risk-reward ratios is key to managing risk. A risk-reward ratio compares the potential profit of a trade to the amount of capital at risk. For example, a 1:2 risk-reward ratio means that for every dollar risked, the trader expects to make two dollars in profit. Maintaining favorable risk-reward ratios ensures that even if a trader experiences losses, their winning trades can compensate and still lead to overall profitability.

Capital allocation and leverage also play a significant role in risk management. Leverage allows traders to control larger positions with a smaller amount of capital, potentially increasing profits. However, leverage can also magnify losses, so it’s essential to use it wisely. Traders should allocate a reasonable portion of their capital to each trade, avoiding overexposure to any single position. Keeping leverage low, especially when starting out, can help traders avoid the risk of a significant loss.

News and unexpected events can have a dramatic impact on the EURUSD market, leading to sudden and sharp price movements. Major economic announcements, central bank decisions, or geopolitical events can trigger volatility, causing the market to move quickly. Traders should be aware of upcoming news events and adjust their risk management strategies accordingly. Setting tighter stop-loss orders or avoiding trading during times of high uncertainty can help reduce the risk of being caught in unexpected market swings.

Advantages and Disadvantages

Pros

- High Liquidity: EURUSD is the most liquid currency pair, allowing for quick and efficient trade execution.

- Tight Spreads: Due to its popularity, EURUSD typically has very tight spreads, reducing trading costs.

- Volatility During Key Sessions: EURUSD experiences significant price movements during the overlap of the London and New York sessions.

- Data Availability: Plenty of economic data from both the Eurozone and the US, allowing for better analysis and strategy development.

- Ideal for Various Strategies: EURUSD is suitable for scalping, day trading, swing trading, and long-term position trading.

Cons

- Volatility Risk: While volatility offers opportunity, it can also result in quick, significant losses for unprepared traders.

- Economic Dependency: EURUSD is heavily influenced by economic reports, which can lead to unpredictable price movements.

- High Sensitivity to Central Bank Policies: Decisions by the ECB and the US Federal Reserve can trigger sudden shifts in the market.

- Geopolitical Risk: Political events in either the Eurozone or the US can cause heightened market uncertainty and instability.

- Overtrading Risk: The accessibility and liquidity of EURUSD can tempt traders to overtrade, leading to emotional decision-making and losses.

Conclusion

EURUSD is a fundamental currency pair in the forex market and offers a wide range of opportunities for traders due to its high liquidity, low spreads, and frequent price movements. Whether you’re a beginner or an experienced trader, understanding the factors that influence EURUSD and applying proper trading strategies can help you succeed. By staying informed about key economic data, using technical tools, and managing risk effectively, traders can capitalize on the dynamic nature of EURUSD trading.

To get started trading EURUSD, it’s essential to choose a reliable trading platform and broker that offers competitive spreads and the tools you need to analyze the market. Explore the available platforms like MetaTrader or cTrader and open a demo account to practice trading in a risk-free environment before committing real capital. Start your EURUSD trading journey today by signing up with a trusted broker and applying the strategies outlined in this guide.

eurusd Trading Strategies

Summary

EURUSD is a staple for day traders, offering a combination of high liquidity and frequent price movements that make it ideal for short-term strategies. The pair's consistent activity throughout the trading day provides ample opportunities for those seeking to make quick decisions. Scalpers are particularly drawn to its tight spreads and the ability to enter and exit positions within minutes, capitalizing on even the smallest price fluctuations. It thrives in highly liquid environments where fast-paced action is key. News traders appreciate EURUSD for its sensitivity to major economic announcements, especially during high-impact events. It often reacts swiftly to market sentiment, offering great opportunities for those looking to trade on volatility during news releases. Swing traders find EURUSD especially attractive, as its regular reversals and price corrections offer the perfect setup for capturing medium-term moves. It balances volatility with enough liquidity to ensure traders can capitalize on market swings over days or weeks.Discover Trading Strategies

Start Your eurusd Trading Journey with TRADE.com

Open a Real Money Account

Sign up with TRADE.com and start trading eurusd with as little as $500. Trade in real markets and take advantage of opportunities.

Open a Real AccountOR

Practice with a Demo Account

Not ready to trade with real money? Start practicing with TRADE.com’s demo account. Risk-free and no obligations.

Open a Demo AccountReasons Why eurusd Trading Is Popular

-

Low Spreads

-

High Liquidity

-

Trading Hours

-

News-Driven

-

Correlation

Trading Calendar

Stay up to date about relevant news affecting eurusd

eurusd Technical Analysis

Explore key technical indicators that can guide you in making more informed eurusd trading decisions.