Indices

On this page, you can find in-depth information about Indices Trading. Whether you're just getting started with trading indices or looking for new strategies, TradingSheets.com equips you with everything you need to succeed in the world of indices.

67% of retail investor accounts lose money when trading CFDs with this provider.

What is Indices Trading?

Indices trading is a way to speculate on the overall movement of a group of stocks bundled into a single instrument known as a stock index, such as the S&P 500, NASDAQ 100, or DAX 40, without needing to invest in each company individually. Instead of buying shares of Apple, Microsoft, or Amazon, for example, you trade the collective performance of all those companies if they’re part of an index, making this form of trading ideal for those seeking broad market exposure in a simplified form. Each index reflects the performance of a specific segment of the market, and when you trade an index, you’re essentially predicting whether the overall value of that index will go up or down. You can do this through derivatives like CFDs or futures, which let you trade on price changes without actually owning the underlying assets.

How Does Indices Trading Work?

Trading indices is about reacting to the overall sentiment and direction of the market, rather than focusing on individual stocks. You open a ‘long’ position if you expect the index to rise or go ‘short’ if you think the market is headed lower. The price of an index is calculated from the weighted value of its component stocks, and changes in these stocks—especially the heavyweights—can push the index up or down. You don’t own the actual stocks in the index, but you can profit (or lose) based on how the index moves by using leveraged instruments provided by trading platforms.

Why Traders Like Indices

One of the biggest attractions of indices trading is the built-in diversification, as you’re automatically exposed to a basket of companies, which reduces the risk associated with any single firm’s bad news. Major indices also tend to be less volatile than individual stocks, though they still offer plenty of movement for short-term trading strategies. Costs are typically lower too, especially when trading major indices with tight spreads. And since most global indices can be traded nearly around the clock five days a week, this market fits well with a variety of trading schedules.

Indices vs. Stocks

When comparing indices trading to trading individual stocks, the key difference lies in the scope and risk. With stocks, your success or failure depends on the performance of one company; with indices, you’re dealing with broader market forces. Indices are usually less volatile because they average out the performance of many companies, while stocks can swing wildly on earnings reports or headlines. Also, trading a diversified index is more cost-effective than building a portfolio of dozens of stocks.

| Feature | Indices Trading | Stock Trading |

|---|---|---|

| Assets | Groups of stocks (e.g., S&P 500, NASDAQ) | Individual company stocks |

| Risk | More diversified, lower risk | Higher risk as focused on one company |

| Volatility | Generally less volatile | Can be highly volatile depending on the stock |

| Costs | Fewer transactions, more cost-effective | Buying multiple stocks can be costly |

Popular Stock Market Indices to Trade

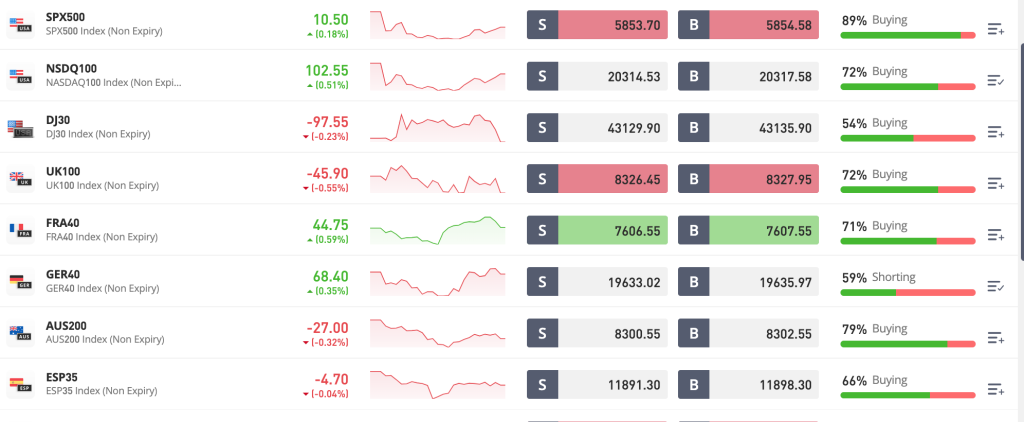

Among the most traded indices in the world are the S&P 500, which covers 500 of the largest US companies and serves as a benchmark for the US market; the Dow Jones, which follows 30 large American corporations and is often used as a sentiment indicator; the NASDAQ 100, with its focus on technology giants and growth stocks; the DAX 40, which captures the pulse of Germany’s corporate sector; and the FTSE 100, which represents the UK’s largest publicly listed firms. Each of these indices behaves differently based on the economic environment, making them popular for both day traders and long-term investors.

Getting Started: What You Need

To trade indices, you need a trading account with a regulated broker that offers access to index CFDs or other derivatives, as well as a reliable trading platform like MetaTrader 5, cTrader, or TradingView. You’ll also need some initial capital—though thanks to leverage, this can be relatively small—and a strategy that fits your time, experience, and risk appetite. It’s highly recommended to begin with a demo account so you can learn how the market behaves and get familiar with placing trades before going live.

How Index Values Are Calculated

Each index uses a different method to calculate its value. For example, the Dow Jones is price-weighted, meaning companies with higher stock prices have more influence on the index’s direction. In contrast, the S&P 500 is market-cap-weighted, giving more weight to larger companies. This matters because a single company like Apple can have a disproportionate impact on an index if it carries a lot of weight. Understanding how your chosen index is calculated helps you better anticipate how news or earnings might affect price movement.

Basic Trading Strategies

Beginner-friendly strategies include day trading, where positions are opened and closed within a single trading session to take advantage of short-term volatility—often in indices like NASDAQ or DAX which can move fast during earnings season or major economic events. Then there’s swing trading, which targets multi-day moves and allows traders to hold positions for several days to weeks. For those with a longer horizon, position trading is all about capturing large trends over months or even years, relying heavily on fundamentals like interest rates, inflation, and macroeconomic policy. Each strategy comes with its own risk-reward profile, and the best approach often comes down to your personality and trading availability.

More Advanced Techniques

Advanced traders often use trend-following strategies, aiming to ride strong upward or downward moves using moving averages or momentum indicators. Others prefer range trading, buying near support and selling near resistance when markets are flat. Algorithmic traders might program bots to react to specific market conditions, executing trades faster than any human could. And then there are scalpers—those who hunt for tiny price moves and might open and close dozens of trades per day. While these methods require more experience and screen time, they offer powerful ways to capitalize on market behavior.

Technical Tools for Traders

When trading indices, most traders rely heavily on technical indicators. Moving Averages help identify the direction of the trend, RSI and MACD are used to confirm momentum and spot reversals, and Bollinger Bands can signal periods of high or low volatility. Traders also watch price patterns like head and shoulders, triangles, and double tops to anticipate breakouts or pullbacks. While no tool is perfect, combining several indicators can give you a clearer picture and improve your timing.

Economic News and Global Events

Index prices react quickly to economic releases such as inflation numbers, GDP data, or central bank rate decisions. News trading—entering positions just before or after major announcements—is a popular strategy but requires precise timing and tight risk controls. Beyond economic data, global events like elections, pandemics, or geopolitical tensions can trigger sharp moves in indices, and staying updated on world news is essential for risk management.

Leverage in Indices Trading

Leverage lets you control a large position with a small amount of capital. For example, with 10:1 leverage, you can open a $10,000 position with just $1,000. While this increases your profit potential, it also magnifies losses, and poor use of leverage is one of the fastest ways traders blow up their accounts. Always set stop-losses, manage your position sizes, and never risk more than 1–2% of your total capital on a single trade.

Can You Trade Indices with $100?

Yes, thanks to micro-lot accounts and low deposit requirements, many platforms allow you to start trading indices with as little as $100. However, it’s important to set realistic goals, manage leverage conservatively, and stick to major indices with tight spreads. The key is not to rush into large trades but to grow your account steadily while learning the ropes.

Building a Winning Mindset

One of the biggest differentiators between successful and unsuccessful traders is mindset. The market will test your patience, discipline, and emotional control. Greed leads to overtrading; fear leads to hesitation. The solution is to develop a clear trading plan, stick to it, and treat each trade as one small decision in a much bigger journey. Losses are part of the game; what matters is how you handle them.

Is Indices Trading Right for You?

If you enjoy macroeconomic trends, want exposure to large parts of the market without picking individual stocks, and like the idea of trading flexible hours, then indices trading could be a great fit. It offers opportunities for both short-term and long-term traders, with enough liquidity and volatility to suit nearly every style. But like any form of trading, it requires knowledge, patience, and discipline to succeed.

Conclusion: Is Indices Trading Right for You?

Pros

- Diversification: Trading indices gives you exposure to a basket of stocks, reducing the risk associated with investing in individual companies.

- Liquidity: Major indices like the S&P 500 and NASDAQ 100 are highly liquid, meaning trades can be executed quickly and at competitive prices.

- Leverage: Indices trading often offers access to leverage, allowing traders to control larger positions with smaller amounts of capital.

- 24/5 Trading: Many indices can be traded nearly around the clock, providing flexibility in trading hours.

Cons

- Volatility: While volatility can provide trading opportunities, it also increases the risk of sudden market moves.

- Complexity: Indices trading requires an understanding of economic indicators, global events, and market sentiment, which can be challenging for beginners.

- Leverage Risks: While leverage can magnify profits, it also magnifies losses, making it essential to use leverage carefully.

How To Start Trading In 15 Minutes

Start Your Trading Journey with capital.com

Open a Real Money Account

Sign up with capital.com and start trading Indices with as little as $100.

Open a Real AccountOR

Practice with a Demo Account

Not ready to trade with real money? Start practicing with capital.com’s demo account.

Open a Demo AccountCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.